We start with front months from our brokers and use an algorithm to build the forward curve.

To build a forward component premium we use the following methodology:

We take the past 18 months - 2 years of premiums received from our brokers for each component (we don't use more than this as we find the fundamentals tend to have shifted to make older data much less relevant).

We then look at the related forward curves and try to find a correlation between that curve and the premium, this can vary in levels of complexity.

For euro grade we found the premium correlates with moves in gas/nap and use a fixed premium + % of gas/nap to derive the premium for each forward month

For reformate the premium correlates with flat price / gas-nap / gas-butane which we use to determine a blend value of the reformate into the local marker grade, in Mar and Sep the season change spread (Mar/Apr and Sep/Oct EBOB) and a floor when gas/nap goes -ve .

Using these individually constructed premiums for each component in each region we can then build a forward curve.

The values we display in the tool and use in our calculations are then a combination of the brokers spot value and our forward curve. For the front month we will just use the broker supplied premium, for the forward months we will use a gradually reducing proportion of the broker and increasing proportion of our constructed premiums with month 6 being 100% our premium. This avoids sudden step changes from the broker quote and our model.

Our model will never full fit the market because it doesn't take into account supply / demand in the prompt etc, but we review the correlations every 3 months or so to update them using the latest data and check they are still appropriate.

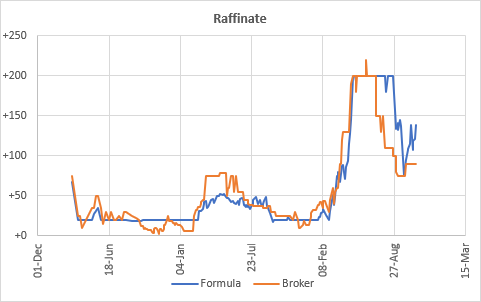

Any example of model vs the broker assessment in ARA for raffinate.